The 5 Most Common Sales & Operations Planning Mistakes and How to Avoid Them

My 13-year-old daughter recently asked me what I do for a living. Answering was harder than I thought. She didn’t have all the years of associations connected to certain industry terms.

To make it simple, I used an analogy: “You know how GPS systems work, right? We put in a destination, and then it tells us the route. And if we make wrong turns, it’ll help us get back on track.

Companies’ strategic goals are where they want to go, and Sales and Operations Planning is like a GPS. S&OP processes help companies get to their goals, and maybe more importantly, help them auto-correct (“recalculating, recalculating”) if they get off-track along the way. I help companies do that.” She got it, but then asked a really insightful question (out of the mouths of babes!): “Why do they need your help? That seems pretty straightforward, Dad.”

She had a point. S&OP (also known as Integrated Business Planning or IBP) is based mostly on common sense, but it turns out executing S&OP best practices is hard. Planning without execution is hallucination - you simply don’t get the benefits of S&OP without executing the process correctly, yet many things can get in the way.

Most companies are organized along functionally focused departments, oftentimes with conflicting metrics. In addition, companies of all sizes are complex social environments with high volumes of data floating around. As a client once told me, “We are drowning in details, but can’t see the important things.” As S&OP has become more pervasive, my role has shifted. I’ve moved from being an “S&OP evangelist,” and explaining why to do S&OP, to an “S&OP engineer,” and advising on how to do it successfully.

Here are a few common mistakes I see over and over again. If you can avoid them, you’ll be well down the path of being able to execute S&OP best practices and consequently reap its well-publicized rewards.

1. Lack of executive ownership.

The biggest problem I see is the executive leadership team not owning the S&OP process. If executive leadership isn’t fully engaged, the process won’t be as successful. If they aren’t engaged, find out why. Maybe you aren’t giving them the things they need to run the company: forward-looking, global visibility; timely, concise information that is digestible to them (e.g. their KPIs) and that is actionable; the ability to ask “what-if” questions so they can put boundaries around their risk. A good technology platform can help tremendously here. After all, the best people and process can only take you so far. Technology serves as a lever to speed up the process and shift the focus from calculations to analysis.

2. No cross-functional engagement.

The whole point of S&OP is getting the entire organization moving in the same direction. That’s hard to do without the involvement of all the key stakeholders in the process. Research around S&OP failures right after the global downturn showed that a third of the respondents didn’t have Sales engaged in the S&OP process. That was the good news! Almost half didn’t have Operations or Finance engaged. Lack of a way to translate between different functional views of information tended to leave one or more participants out of the process. Sales would input revenues by account, Operations would need demand in units by product, and Finance wanted to see net margin. To really make S&OP work, you need to have the same information, but expose it to each stakeholder in the form they need and understand. Even if you start with a quick win/small project, extend the scope to just across the functional boundaries to provide the needed translation.

Constrained vs. Unconstrained Demand and S&OP

Does this sound familiar?

The Sales VP is agitated…very agitated. “Don’t tell me what you CANNOT do, I made the sale, now you fill the orders!!!” The Operations VP responds in kind, “Your forecast was not even close to what you just booked. We cannot increase supply that fast!”

Where do they fit in an S&OP cycle?

Sales and Operations Planning (S&OP) serves as a critical process to project, balance and manage the integration of supply and demand. The process starts with the demand signal. The Sales organization collects bottom-up forecasts from the distributed sales force. Sales management provides a top-‐down review injecting market and product insights. At this point, no supply constraints have been levied to temper the forecast. Thus, we refer to this as an unconstrained demand forecast.

Where do they fit in an S&OP cycle?

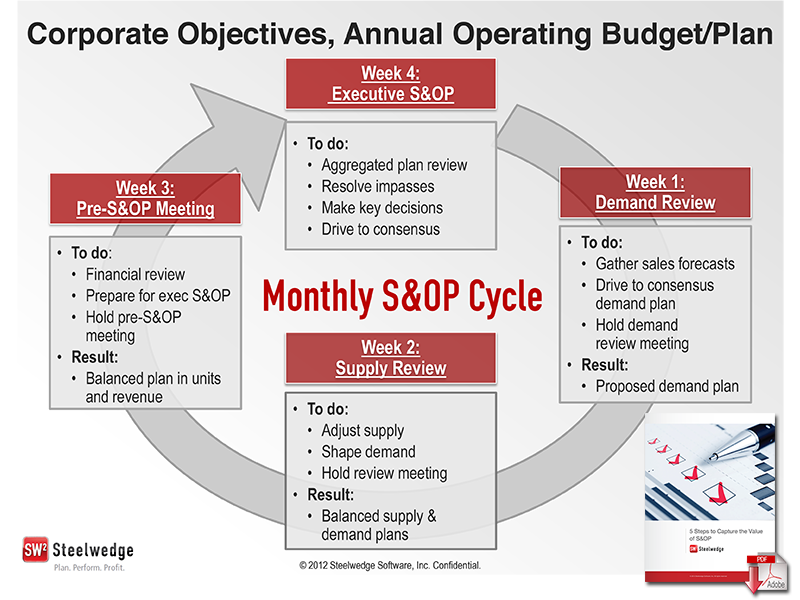

The S&OP cycle continues with demand and supply reviews. The intent of these cycle steps is to validate assumptions, check reasonableness and align resource plans needed to support planned demand. Although planning horizons vary from one business to the next, in general, manufacturers must commit in advance to facilities, material purchases and even labor. These supply side plans will limit the ability of the organization to significantly exceed its projected business level. Limitations tend to be tighter in the near term with greater flexibility in the medium to long term.

Through the S&OP process, the organization sets a projected business level that balances expected sales and production capabilities with financial and inventory implications. The constrained demand plan reflects a demand plan aligned with the supply plan.

Whitepaper Download: 5 Steps to Capture the Value of S&OP

Do we need both?

Many companies find it useful to distinguish and track the gap between unconstrained and constrained demand plans. An increasing gap may indicate lost opportunity to realize sales that exceed current capacity. Companies should scrutinize unconstrained demand signals to verify demand is real versus “pie-in-the-sky.” Long term capital improvements aimed at increasing capacity need to be aligned with realistic projections of future demand.

Finally, the constrained demand plan feeds a consensus plan to which the organization agrees to execute. Our Sales and Operations VPs need to stop fighting and starting aligning. S&OP facilitates this necessary collaboration.

Reduce Surprises. Reduce Inventory. Improve Operational Efficiency. Increase Sales.

3. Focusing only on one consensus number.

An S&OP mantra for years has been getting to a “one number plan,” but this simplifies things too much. And worse, it limits the value of S&OP for executives. Executives are paid for predictability. It’s their job to identify and proactively mitigate risk – to avoid the danger before it’s a reality. S&OP can be a great tool to help (i.e. GPS telling you to avoid a route due to traffic) but only if you don’t fall into the “one number” trap. Instead, you need to plan in ranges – worst case, best case and expected – all along the S&OP process. The ability to identify the impact of things not going to plan is priceless. As Eisenhower once said, “Plans are nothing; planning is everything.”

4. Complexity!

Follow the “keep it simple” principle, especially with metrics. I’ve seen companies become paralyzed trying to make the right decision when they have to evaluate hundreds of metrics; the complexity prevents them from being able to ask the right questions. Pick your big 10-15 metrics (see Figure 1) and go with them. Track them, make performance transparent so everyone understands where they are, and learn from them.

5. Lack of documentation.

How do you learn from your mistakes? You have to capture all the institutional knowledge and assumptions that go into your plans. Provide a mechanism to capture this information from every participant, and make it easy for them to contribute. For example, if you collaborate as a group using social media, automatically capture those chats and the context and embed it into the plan assumptions so you can understand the context of decisions or changes six months later. Remember, those who don’t learn from history are doomed to repeat it.

You’ve seen the evidence; S&OP can provide great results, but if you don’t execute the process correctly, you will struggle to achieve success. Avoid these mistakes and you’ll arm your company with an excellent GPS system to help guide you to your goals.

About the Author

Danny Smith, Steelwedge’s VP of Industries, helps companies leverage Integrated Business Planning (IBP) and Sales and Operations Planning (S&OP) processes to meet their strategic goals. He has a 20+ year track record of using technology to solve real-world business problems, most recently as Oracle’s global solution champion for IBP. As a Strategic Planning Manager for a Fortune 300 company earlier in his career, Danny experienced the pain of orchestrating an effective planning process without the right technology platform, which launched him on his career path of pursuing a better way to deliver on the promise of IBP.